Let’s face it — most of us are Apple investors. If you deny, look at top ten holdings of any mutual fund that you own. Unlike old superstar stocks of the past — Intel, Microsoft or Dell to name a few — there is something unique about Apple. It has brand loyalty that is unlike any tech companies of the past or the present.

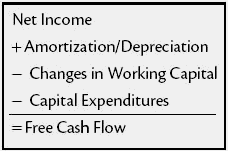

Now, let’s look at Apple stock from its ability to increase dividend consistently. Apple is generating over $10 Billion in free cash flow every quarter. That amounts to over $40 Billion a year. More importantly, Apple has managed to generate higher free cash flow every year in the past decade.

Now, let’s look at Apple stock from its ability to increase dividend consistently. Apple is generating over $10 Billion in free cash flow every quarter. That amounts to over $40 Billion a year. More importantly, Apple has managed to generate higher free cash flow every year in the past decade.

This is important for those seeking consistent income as you can bet on Apple’s ability to increase dividend yield in the future.

It is likely that Apple will keep adding to its share buyback program while keep growing its earnings with innovation which in turn will boost dividend payout over the foreseeable future.

Success of iPhone 6

For naysayers and those who believed that Apple’s best days are in rear view, Apple has again proven you wrong. iPhone 6 has been a huge success. What intrigued me — besides the staggering number of iPhone 6 sold in just the few days after the lunch in September — is the fact that over 40% of the new buyers were Samsung users in the past.

First Weekend iPhone Sales Top 10 Million, Set New Record. CUPERTINO, California—September 22, 2014— Apple® today announced it has sold over 10 million new iPhone® 6 and iPhone 6 Plus models, a new record, just three days after the launch on September 19. — Yahoo Finance

China mobile and Union Pay Deals

Despite all the barriers to do business, China is Apple’s second biggest market. That is a testament of growing, loyal customers in one of the largest markets in the world. China mobile is the largest carrier in China and the recent deal with Union pay will make it even easier for Chinese consumer to buy iPhone without upfront payment. Think about the future top line growth from these silent deals Apple has scored in the recent months.

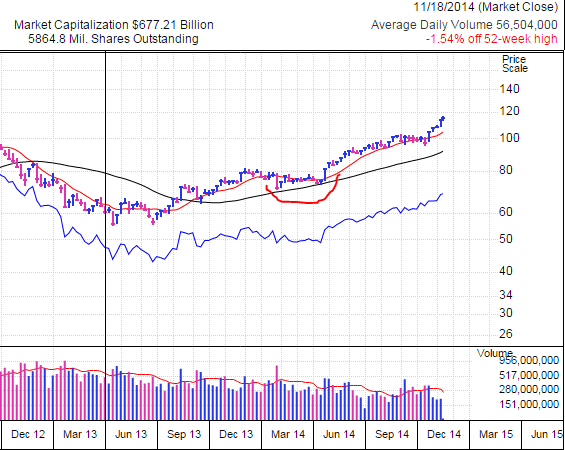

Nice Looking Chart

I like charts as you can learn market behavior for the stock by paying attention to price and volume. Besides, pundits on CNBC can lie but chart won’t. Apple’s chart looks good and if nothing, it tells me that at around $80 price range, stock has good support as large institutional buyers are buying at that price. That will be the price I am willing to pay to add to my position.

I like charts as you can learn market behavior for the stock by paying attention to price and volume. Besides, pundits on CNBC can lie but chart won’t. Apple’s chart looks good and if nothing, it tells me that at around $80 price range, stock has good support as large institutional buyers are buying at that price. That will be the price I am willing to pay to add to my position.

Two years ago, I believed that Apple is one of the best investments of the decade and it still has potential to become a first American company with market capitalization in excess of a trillion-dollar.

While I don’t have a crystal ball to know when Apple will become a trillion-dollar company but I sure intend to keep adding to my Apple investment every time I can buy shares at a discount.

Disclaimer: I am not an investment adviser. These are my personal views so please invest after doing your own research.