I still vividly remember the famous Time magazine cover showing Steve Jobs. He returned as an interim CEO of Apple and took $150 million investment from Bill Gates.

I still vividly remember the famous Time magazine cover showing Steve Jobs. He returned as an interim CEO of Apple and took $150 million investment from Bill Gates.

That was year 1997.

In the next 14 years he brilliantly transformed a once nearly bankrupt company into a one of the most successful brands in the world before he passed away in 2011.

If you were as brave as Ning Wang and his wife Ting Qien — or just followed the footsteps of Bill Gates — your investment of $2500 in 1998 would have turned into over $1 million today.

I started investing in Apple stock in 2007 and it hasn’t let me down either. My strategy has been to add more shares at every dip as I believe that Apple is still an undervalued company. I invested more when pundits on CNBC advised everyone to sell their apple stock.

I wasn’t as astute as the Wang family to invest way back in 1998, but my investment has increased 10 fold or tenbagger, a term coined by famous Fidelity fund manager Peter Lynch. Not bad.

If you are a street smart investor, follow Oracle of Omaha closely instead of following pundits on CNBC. Warren Buffett has been the most successful investor ever yet he always avoided technology stocks in the past. Not anymore.

He has invested in Apple stock since 2016 and his Berkshire Hathaway has now over 225 million shares of Apple. That makes it the third largest shareholder of Apple. Heck, he likes Apple so much that he would like to own the entire company. That’s sweet news for all Apple share holders since Warren Buffett is known for his belief in the long-term investment.

Why is it still a great investment?

Let’s take a peek at the third quarter result that came out last week — and it fueled the stock to cross $1 trillion market cap — to understand why Mr. Buffett is so much in love with his Apple investment.

Apple’s revenue jumped 17 percent and EPS(Earnings per Share) jumped 40 percent. These numbers are not from a startup company but the most valuable company in the human history.

“We returned almost $25 billion to investors through our capital return program during the quarter, including $20 billion in share repurchases.” — Apple CFO

Apple share repurchase in the long run will improve return on investment for all share holders since it will improve its earnings per share as float decreases. This is the company that has over $247 million in cash and has announced that it will be cash neutral ever since President Trump announced his tax overhaul.

Apple’s service business grew 31 percent over the past year. In just few short years, this business itself has revenue of over $9.5 billion in the current quarter. This is a great feat considering the fact that Apple’s service business is as big as Facebook’s entire business revenue.

For long, Apple’s flagship product has been iPhone and it has seen the ASP(Average Selling Price) of $724 which beat the analysts’ estimate of $693 despite heavy competition from Samsung and now Chinese company Hyawei. But, along with their service business which is growing rapidly, Apple is also growing its product ecosystem by selling more wearable products like apple watch.

A great leader

A long-term, great investment ought to be measured by not only a great brand but also equally brilliant leader. Tim Cook has proven that he has what it takes to run world’s first trillion-dollar company.

“Financial returns are simply the result of Apple’s innovation, putting our products and customers first, and always staying true to our values.Steve founded Apple on the belief that the power of human creativity can solve even the biggest challenges — and that the people who are crazy enough to think they can change the world are the ones who do,” — Tim Cook

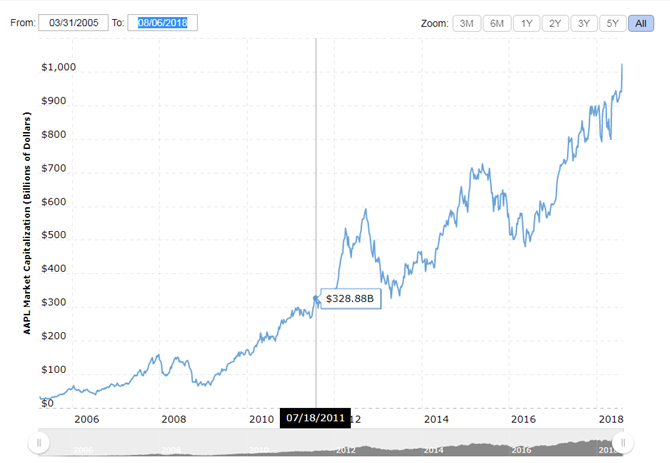

Apple’s market cap was $320 billion when Tim Cook became CEO on August 24, 2011. Apple’s market cap crossed the historic trillion-dollar mark last week.