Investing is intimidating for most of us mere mortal souls. With so many ways to invest — and so many products to choose from — it has become a task as difficult as a task for a kid to decide which candy to buy from a candy store.

We often ignore the hidden cost of handing money over to the pros — who constantly deliver less than an Index fund — just so that we feel good about letting professionals shape fate of our golden years.

Consider this fact: If you invest $100,000 for 10 years in a mutual fund instead of Vanguard family of funds, you will end up paying, on average, $15,541 more just in fees to these pros for not growing your wealth due to their high expense ratio, 1.11% compared to Vanguard’s 0.19%.

Do I believe that you ought to invest every dollar into different Vanguard funds? Absolutely not. It’s essential to allocate one third or half of your investment for Vanguard Index funds, but it is also crucial to learn ways to invest safely on your own to grow your nest egg.

If you decide to become steward of your financial future, you will need financial habits to ensure financial fitness in your golden years. And it’s not an easy feat to achieve.

If you are fretting over the task of do it yourself investor, don’t let your heart be troubled. I want to share story of a woman, Anne Scheiber, who grew her wealth from a modest $5,000 to $22 million by the time she passed away. As I read more about her, it was evident that you can build wealth if you develop mind-set, discipline and perseverance to do so.

Anne compounded her money at an amazing rate of 22.1% annually for 50 years to turn a small amount into $22 million. And her feat puts her next to the sage of investment, Warren Buffett who returned 22.7% when he was actively managing investments back in 60’s.

As you can imagine, Anne’s attitude towards her money was not much different from that of Oracle of Omaha. The only difference is that this little lady showed us how to build wealth way before the age of Internet with plethora of information readily available to us.

1. Remember it is your money

You can’t invest unless you have capital to do so. You need to save money so that same money can save you in your retirement years.

Anne was thrifty — may be way thrifty for most of us — but that was the essential habit that allowed her to have capital to invest even long after she retired from her job as an auditor. And get this: she never made big salary while she worked. Nonetheless, she never allowed her meager salary to stop her from building wealth.

In the consumerist culture, it is easy for us to live and look like Jonseses. Learn to care less about how others think about you because others have no vested interest in your financial well-being.

Anne was saving 80% of her disposable income. That may be difficult for most of us who have family, but we still can learn from her to value ancient virtues of thrift and savings for the future.

2. Invest in big names

It is easy to succumb to your desire to invest in next Apple or Microsoft while these companies are in their infancy. The truth of the matter is that you will have ample time to invest in the next Apple or Microsoft long after they become household names.

It is easy to succumb to your desire to invest in next Apple or Microsoft while these companies are in their infancy. The truth of the matter is that you will have ample time to invest in the next Apple or Microsoft long after they become household names.

Consider investing in companies with consistent earnings and sales growth not for few years, but for 10 years or more. Consider also those companies with big capitalization of over $1 billion or more and those that are paying dividends such as Johnson & Johnson, GE, AT & T, and yes even boring Wrigley’s(maker of famous chewing gums).

The best place to look for big names is none other than Vanguard large cap index fund.

3. Don’t pay attention to P/E ratio

One of the biggest myths of investing is to find companies with lower P/E(Price-to-earnings) ratio. If P/E is the sole barometer of a good investment, everyone who has invested in Amazon should sell that stock now to invest in Apple.

Anne looked for companies with consistent earnings and sales growth. Like Warren Buffett, she invested her money only in companies whose business she understood well. Look for industry that you know well and find companies that can grow their earnings with reasonable degree of certainty.

Amazon’s higher P/E ratio indicates that investors believe not only in its power to dominate but also to grow its revenue and earnings for many years in the future.

4. Invest in your area of interest.

Another legend I admire most is Peter Lynch. He probably holds a record of returning close to 30% for over 20 years while he was managing Fidelity. In fact, he made little, obscure name of Fidelity a household name by the time he retired even before the age of the Internet bubble.

Peter Lynch in his must read book, One up on the Wall Street, talks about investing in what you enjoy most.

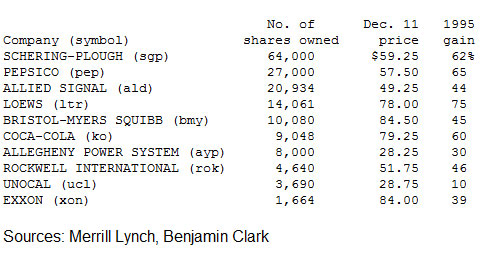

Anne practiced Peter’s advice long before Mr. Lynch took helm of the Fidelity Fund. She enjoyed movies. That single interest of hers allowed her to make big money with major names such as Columbia and Capital Cities/ABC which Warren Buffett’s Berkshire owns a major stake in.

5. Invest slowly.

Our instinct always tells us to buy every share of the next big kahuna we find. That’s certainly fool’s game. I believe in investing a small amount and keep adding more regularly even if price keeps going up.

This is akin to investing in a business and throwing every dime initially without testing the water. In any business, you only inject more capital once you find a plausible return from that investment. Why would investing in stock be any different?

As long as you believe in your investment, keep adding more regularly to your position.

6. Buy more, sell less.

This sounds like a cheesy slogan, but I am a big fan of “Write less, do more” cult of programmers. Anne seldom sold her shares. In part because she hated the cost of transaction, and because she considered every investment as her own business.

She attended every shareholder meetings and asked kinds of question a shrewd auditor asks. She knew what she was investing in. That allowed her to detach her emotions from noise in the media. She recognized that media loves to slam stocks going down in price not because it is an overnight bad investment.. but mostly because it is in vogue to do so.

This is another reason for you to cut your cable today and take in charge of your financial destiny. It’s loser’s game to listen to these pundits who change their opinion about every investment as often as your local weatherman changing his forecast.

7. Beware of buy and hold crowd.

This may sound antithesis to never selling your investment advice you just read, but it’s also true that the buy and hold strategy can kill your portfolio.

Anne believed in staying informed about her investments. She not only attended every shareholder’s meeting but also demanded answer from CEO or CFO when she felt compelled to do so.

You can’t allow ignorance to spread like weed and kill your beautiful garden of investment. You never invest in a business that you wanted to run on your own and let your employees decide the success or failure of your investment. Investing in stock market needs similar mind-set.

Investing is a daunting task for most of us. But if a woman with mere $5,0000 can turn it in to $22,000,000 in 50 years in days when an average investor knew very little about investment, and in days when access to financial information was not readily available, there is no reason why any of us can’t amass a small fortune by learning from Anne’s exemplary character of frugality, investment acumen, and perseverance.

Do you agree?

photo by: Keltikee