Let’s face it — most of us, mere mortals, consider investing ourselves in a stock market akin to playing Roulette in Las Vegas! If you have similar thoughts then you are not alone!

According to Henry Blodget, one time super star Internet stock expert, those who you consider Pro are not so Pro either. This is a shocker for those of you who hand your money to a Pro with fake sense of security. Where am I going with this? There is no substitute for your own research and thoughtful decision when it comes to investing your hard-earned money.

I am a big proponent of investing a large percentage of portfolio in an index fund and if you know nothing about Index fund, this blog will make you a Pro in no time! And it won’t cost any fees either.

But, if you have passion to invest in an individual stock, keep reading.

Without boring you anymore, I am going to pick one of my recent trades and walk you through the thought process I used to invest — I don’t care if you tag that as a trade because profit has no ego or emotions — like a Pro yourself.

Let’s meet Terra Nitrogen Company(TNH).

Terra Nitrogen is a producer and marketer of nitrogen fertilizer and methanol in North America and of nitrogen in the United Kingdom for agricultural and industrial customers.

What I like about this company?

No matter if you call yourself an investor or a trader, you need to have an investing framework and rules in place before you invest a single dollar.

- Nice Yield: TNH used to trade at 173. In late December, I noticed it at around 92. At that price, yield was at around 7%. Not bad even if I have to wait for stock to go up but I am not too fond of catching a falling knife either so…

- Wait for stock to find a bottom: I am a big believer in reading charts as charts never lie. Charts ignore emotions and portray facts that you can use to make wise decision. If you want to invest like a Pro, you must learn how to read charts.

Stock found bottom at around 92 in early December and it took about a month for it to start showing relative price strength.

- Stock has low float: When stock has low float(outstanding shares available), it moves quickly; especially, if a fund manager buys a big block of shares, stock moves up in a short period of time. That’s akin to an elephant jumping into a bath tub; water is destined to rise!

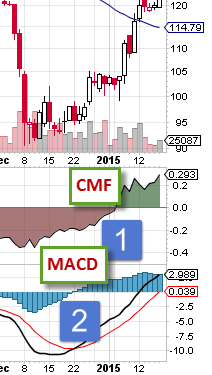

- Chaikin Money Flow(CMF)/MACD: As a safe guard, before entering into a position, I look at Chaikin Money Flow to see if big money is moving into the stock. That along with a strong volume is a much powerful indicator to predict that your investment will rise in value over the time. At any given day, stock can move up or down so I laugh at experts who can predict how stock will perform over the time without giving us any plausible reason. Believe me, what I am showing you works for me as I trust my own research and technical indicators to decide when to invest in a stock.

It is evident from the chart that at around $100 in early January, both CMF and MACD turned positive as stock started its ascending move. For me this was the right time to buy.

Additional tips:

1. I normally sell stock if it moves up 20+ % in the first 30 days; or, I sell covered call at the price slightly higher than the next resistance for the stock. If you consider 5-7% yield along with additional income by selling covered call, you can make money while waiting for stock to go up.

There is always an opportunity to make money in the market. All you need is your own set of rules based on what works in the market without allowing your ego or emotions to influence your investment decision.

Never allow pundits of national media or some stock broker to decide fate of your financial future. Instead, invest in a low-cost Index fund such as Vanguard’s total market fund if investing in stock is not your cup of tea.

photo by: Carl’s captures