Let’s face it, not all investments are made equal. How to invest money is as much or more important than how to earn and save money. I have known many friends who always think that stock market is too high or feel that they have missed the boat. Once they buy stocks, they worry that market will crash.

It’s hard to find happiness when your heart always craves for the worst, but that’s how masses think. And that’s why money masters can manipulate them easily.

Think Simple

Simplicity is an extinct virtue in our world. Indeed, technology revolution has made plethora of information available for mere mortals. In short 20 years, we now can access information about any publicly traded company that was only available to Wall Street elites before. Think about it.

Having said that, more information is overwhelming to most investors as they get opposing views on how to invest money in the market. In few clicks, you can read about why Apple is still a great investment. And, with few more clicks, you can also read about why Apple is the worst stock your money can buy.

Everyone wants your dollar. All kinds of mutual funds and equal or more number of insurance companies want to invest your hard earned dollar. Of course, they are interested more into robbing you every step of the way by swiftly charging a seemingly small amount for ridiculous fees that you don’t pay attention to.

They want you to feel good when you watch a grandfather fishing with his grandson in golden years in one of their advertisements. Isn’t that great? They just don’t want you to know that you are losing thousands in fees all the while not earning enough on your investment to match pace with the major indices.

So, how do you deal with this conundrum? how to invest your money with clarity so that you can grow your portfolio without worrying about imminent crash in the market and avoid experts to rob your hard earned money?

Market always goes up and down, but the good news is that market goes up much more than it ever goes down. While keeping all your money under mattress, or keeping it in a savings account is equally naive as to try to predict every top and bottom of the market moves, finding a balanced approach without losing your sleep is the key to invest money wisely.

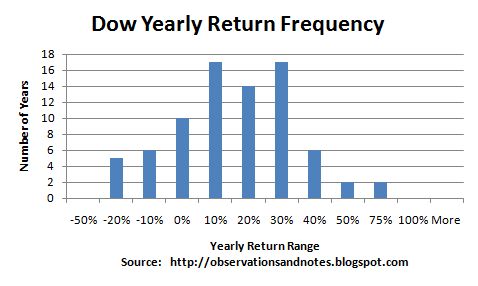

As you can see from this historgram, DOW was in negative territory only 25% of the time. That means, market goes up way more than it ever goes down.

Keep long-term perspective

I like histograms as they depict a clear picture when it comes to insight. It’s clear from this histogram that those who invest for 14 years or more can get rewarded handsomely for their perseverance. Don’t invest if you may need that money in next 15 years. It’s that simple.

Watch they are robbing you

For starters, if you can save 1 percent fees on average that most money managers charge to manage your portfolio, you are saving $1000 for every $100,000 invested. While 1 percent may seem meager amount, never lose sight of the fact that every dollar invested is the dollar working for you. It’s a silent servant who works without making you aware of its existence.

As your portfolio grows due to compounding, you keep paying more to these experts who shamelessly under perform S&P consistently. This is the only profession that allows mediocrity to excel at your expense.

Pay attention to your asset allocation

Enron and General Motors remind us that putting all of your eggs in one basket is a surefire way to bring misery. That’s why I like Gone fishin’ portfolio as it makes investing as simple as you can imagine.

While these are the keys to invest your money wisely, I always consider my pal Jim as the sage on the blogosphere. He selflessly provides wisdom that can save you thousands or possibly millions. In fact, I won’t be surprised that he has influenced many, including me, to learn how to invest money simply. And, I also believe that he has sent millions of dollars worth of business to Vanguard even though he makes no profit from it.

Like Socrates, I know what I don’t know. I am still backpedaling in an ocean of financial wisdom. So, I thought to create a collection of must read articles that Jim has written for anyone who wants to become rich without ever feeling scared about an imminent market crash.

I promise you that if you read all of his 20 articles, you will know more about how to invest simply compare to 99% mere mortal investors in the world. So, get a cup of coffee and keep reading his wisdom. When you are done reading his articles, please visit his site and thank him for his selfless service to the mankind.

If you can’t explain it simply, you do not understand it well enough. — Albert Einstein

How to Invest Money

Stocks — Part 1: There’s a major market crash coming!!!! and Dr. Lo can’t save you.

Stocks — Part II: The Market Always Goes Up

Stocks — Part III: Most people lose money in the market.

Stocks — Part IV: The Big Ugly Event

Stocks — Part V: Keeping it simple, considerations and tools

Stocks — Part VI: Portfolio ideas to build and keep your wealth

Stocks — Part VII: Can everyone really retire a millionaire?

Stocks — Part VIII: The 401K, 403b, IRA & Roth Buckets

Stocks — Part IX: Why I don’t like investment advisors

Stocks — Part X: What if Vanguard gets Nuked?

Stocks — Part XI: International Funds

Stocks — Part XII: Bonds, and a bit on REITS

Stocks — Part XIII: Withdrawal rates, how much can I spend anyway?

Stocks — Part XIV: Deflation, the ugly escort of Depressions.

Stocks — Part XV: Target Retirement Funds, the simplest path to wealth of all

Stocks — Part XVI: Index Funds are really just for lazy people, right?

Stocks — Part XVII: What if you can’t buy VTSAX? Or even Vanguard?

Stocks — Part XVIII: Investing in a raging bull

Those are indeed excellent links! Thanks for sharing!

Thank you, my friend!

Hi-

I came surfing on your blog from Jim Collin’s site… He really has some very wise and sound advise, especially for investment newbie like me. They are also written in simple tones, so any one can understand.

I believe people who are new at this needs consistent, positive encouragement; so I am grateful that blog sites like yours reinforce what I’ve already learned.

Hi CV, you are absolutely right. His articles help newbies as well as those who have invested money in mutual funds without knowing who much they are losing on these hideous fees.

Hi Shilpan…

Just read this post and I think it is one of your very best, and not because of all the generous links to my blog.

In the post I just put up today, I use this calculator in Addendum II: 401kfee.com It is great for illustrating the point you make in your post about the corrosiveness of fees.

I almost didn’t comment on this post. It seems there is no way to do it without it seeming self serving. But I do think it’s a great one and I thank you for making links to mine part of it.

Thank you, my friend! After reading your articles, no one can argue that achieving financial independence is a matter of luck, or matter of windfall one may get again due to sheer luck. In fact, Jack Bogle has made is so simple to invest and you’ve explained it so well in plain English that anyone with firm commitment and persistence can become rich(without ever wasting a minute watching CNBC). My heartfelt thank you for the great service to all of us. And, I am proud to be your friend.

[…] https://www.streetsmartfinance.org/2013/06/28/how-to-invest-money-in-any-economy/ […]

I was amazed at how much fees I pay in my retirement accounts once I actually looked.

Thanks for the providing links to the articles. I am a strong supporter of financial education and literacy as I don’t feel that I came out of the formal education system with a strong foundation to invest and grow my money.

But realizing that no one cares more about my money than me, I knew I needed to seek out the education to understand what I was investing including the costs and risks before just investing blindly.

[…] of you who have read his stock series that I published on this blog can relate to this very notion of simplicity and finesse JL Collins […]