The investor of today does not profit from yesterday’s growth. — Warren Buffett

If you are wondering, the title indeed is dubious. And that’s by design. I am not suggesting that buying a Tesla car may make you rich. At the hefty price tag, it can certainly make you feel rich. But, I believe that instead of buying a car, if you invest in Tesla stock, it may make you rich.

Tesla cars are the sexiest cars ever built: Well, that may be bit of an exaggeration but they are not only making buzz among car fanatics but also among the movers and shakers on the Wall Street. Albeit Tesla is not the first one to build an electric car, it surely has done with finesse and marketing muscle that no other car maker has done before.

I am a firm believer that politics, as usual, hardly solves mankind’s pressing issues. Having an alternate to gasoline is one of those issues. While both political parties have delivered not much than empty rhetoric, Tesla has already become a change agent for this pressing issue.

5 Reasons to Invest in Tesla Stock

1. Fundamentals are improving

A quick look at Zach’s stock screen indicates that although the company is still losing money, all financial indicators are trending in the right direction. Sales growth has accelerated to over 1700% year over year while EPS(Earnings per share) has doubled that from last year. In addition, quick ration — a measure that shows company’s short-term liquidity strength — has risen steadily. Not to mention, both ROE(an important measure for a growth stock) and inventory turnover ratio are improving due to increasing demand for Model S cars.

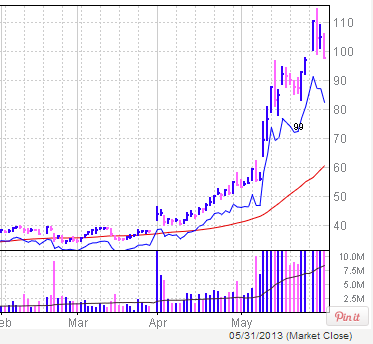

2. Charts don’t lie

The market sentiment for this company has never been better before. The stock has more than doubled in value just in last three months. For now, it may pose risk of a decent pullback, I see that the stock should have good support in the $90 range. With several new models in the pipeline — especially a smaller version which will be affordable to middle-class families — and the positive press about Tesla cars in general, future is anything but promising for this stock.

Also, the float(total numbers of share available for investors) is only 80 million shares. A smaller float always helps stock propel higher in growth phase as demand for the shares outgrows supply.

3. It has brilliant leadership

Elon Musk has proven many times that he knows how to achieve success with relentless pursuit of knowing what marketplace needs and adding a marketing brilliance to skyrocket that success. He did that with PayPal when most people didn’t trust transactions on the Internet.

Unlike others who have failed to sell electric cars to masses, he has learned from those failures and, so far, has skillfully positioned Tesla Cars as the dominant leader in the electric car niche.

I believe that quality of management plays greater role — when it comes to groundbreaking, up and coming companies — in shaping fate of that company than even product itself. Without a great vision and flawless execution, even the most promising company can fail miserably.

Management, led by Elon Musk, owns 30% of the company. That’s the another reason to feel good about its future.

I love it when naysayers say that Elon’s Hyperloop idea is insane. That proves that he is powerful enough and there is no dearth of people who lack vision.

4. Both Left and Right are happy

We all know that both left and right are stalemate at best. While gasoline price plays a crucial role in the public sentiment about the state of the economy, and that both parties agree that our dependence on foreign oil doesn’t make sense for our national security and economic well-being as a nation, both have starkly opposite view of how our nation should deal with this issue.

Enter Tesla cars. This company excites both Red and Blue as it is a symbolic American entrepreneurial story in making for the Red and it is a rising green, eco-friendly company for the Blue. Very few businesses get love from both sides of the political spectrum and Tesla is certainly one among them.

5. Consumers love it.

I live in Atlanta so I know that when Clark Howard — a long time consumer advocate and a very thrifty fellow — bought Tesla, savvy consumers alike will follow his footsteps.

And it’s not just Clark, AutoGuide’s consumer reviews indicate a pattern in making. It reminds me of early days of Amazon. Amazon built a loyal customer base by focusing on amazing, easy to purchase a book experience on the Web. This company is skillfully building a similar customer base.

The road ahead is anything but challenging for Tesla cars or any of its competitors since there is still a degree of skepticism among Americans due to lack of modern charging stations and long-term maintenance, not to mention resale value of the electric cars in general. Nonetheless, if you believe in American entrepreneurial spirit and if you have few thousands laying around in your savings account, It may be more exciting to ride this smooth engine as it makes uproar for some time to come.

After the Roadster, so many people called bullshit on the Model S it was ridiculous, but then we brought it to market. Then they said you’ll never make a profit, and then we did that. So I hope they will observe there is a trend here. — — Elon Musk

Disclosure: I have no position, at the moment, in Tesla stock. This is solely my opinion. You may want to consult a financial adviser before making any investment.

Addendum: In early June, right after publishing this article, I have purchased TSLA shares at $90.75.

Thanks for this Shilpan. I’ve been getting more and more intrigued by Tesla and Musk. I would have guessed when it started that the company would be nothing more than a ‘flash in the pan.’ So much for my analytical abilities. The product surely seems universally admired and lauded. I didn’t Clark bought one–that says a lot about the car (and Clark’s bank account!).

Kurt, it also surprised me to hear that Clark bought this car, but who can blame him when you know that his net worth is over $15 million. 🙂

with my usual caveat that chasing individual stocks is a fools errand, it is fun to dabble — Nothing is quite so intoxicating as owning a rapidly rising stock. My take:

1. the Tesla S is by all accounts a brilliant car and even at its hefty price tag they can’t churn them out fast enough.

2. I am a huge fan of Elon Musk. Talk about a guy who dreams big — you didn’t even mention Space X — and seems to make it actually happen. I mean, a private spacecraft company NASA now depends on?!

3. Still, successful auto manufacturing start ups are as rare as…well I can’t think of anything quite that rare.

4. The USA is already on its way to energy independence. Indeed many predict we will be the largest oil producer in the world and a net exporter of the stuff in the not too distant future. So will we “need” Teslas?

5. On the other hand, people aren’t buying these just to save gas. They are genuinely cool and desirable cars competitive with any in their class.

6. Tesla’s future rests more now on the roll out of less expensive models that are as well received.

7. One of Musk’s biggest goals, and fights, with Tesla is to cut the ties to traditional dealer networks. For those who don’t know, car dealers have managed to make it illegal in the USA to sell cars except thru them. Musk is pushing for the right to sell direct. As you might imagine, the dealers are mounting a major offensive to block this path. Should Musk prevail, unlikely as that is what with the dealers’ political clout, it would be a huge boost for this company.

8. The stock price has already had a major run since early April from under $40 to over $110, before pulling back this week.

My bet is, that against all odds, this will be a successful car company. If anyone can do it, it is Elon Musk.

But the question for us investors: Is that already in the stock price? Beats me.

But I confess I’m tempted. I like the man, I like the vision and I like the potential. And the world likes the product.

Wonderful perspective, Jim. Keep in mind the a growth stock always looks expensive due to its power to make major advances. Nonetheless, I agree with you that short-term risk for a pullback is very real considering stock’s meteoric rise in relatively short time.

If anyone can do it, indeed, Elon can.

Shilpan,

Great article and data. I love the new Tesla S. Living in thge Seattle area, I see them on the road with increasing frequency. Rarely a day goes by now that I don’t spot at least a couple of them in traffic with me.

They look great, have excellent performance, and sand on their own merits as a car, rather than simply an environmental statement.

Seattle definitely is one of the wealthiest cities for sure. So, I am not surprised that there are more Tesla cars on the road there.

The general trend towards hybrids and electric cars is a welcome sign. Breaking peoples perceptions is a difficult thing and I think Tesla is paving the way.

When Solyndra failed, Obama took a lot of flak. Tesla actually prepaid their loan. Kudos to Elon Musk. A sincere government push is a good thing, be it via tax credits or loans.

I do hope EM succeeds.

Agreed that it bodes well for Tesla since it has paid the loan back. Their improving quick ratio indicates that company is firing well on all cylinders.

Not sure on this stock yet. First time really paying attention to them and I actually thought they were private so tells you how much Ive paid attention outside of staring at the cars they make. I just question whether or not its worth getting in right now with that huge run up. I see the pull back but not sure I would pull the trigger and buy any.

I really don’t like to give my opinion about the stock price. My intent is to bring some ideas for new investments that you can consider. I really want my readers to make their own judgement before investing in this or any other stocks that I recommend. It’s always better to think of an investment from a long-term perspective. If you believe that this company can increase its market cap from $12 billion to $50(on par with GM and Ford), it’s a great investment. However, you should think what is the best price to pay for the stock and wait till stock drops to that level.

Barron’s published their take on it last week. They reckon Tesla will need to sell half a million cars at the current stock price. Dream on!

Joe, I haven’t read Barron’s article yet. I believe that with 35% growth, Elon’s team is expecting to sell 1/2 million cars by 2022.

Considering that growth companies command higher P/E, stock price can move much higher.

Thanks for your perspective.

I jumped in a bought Tesla stock a few months ago just after reading the reviews about the car.

Riding my motorcycle back from Seattle to LA, I thought why can’t they make a motorcycle or scooter run on batteries. So far, hasn’t happened.

Tesla car is a great concept. But it’s just not going to work. I hope I’m wrong, but I don’t think so.

I sold my stock and made 40% though in the short time I had it. Plus I bought it through my Roth, so I don’t think I have to pay any short term taxes or anything like that. Not sure though on that.

Actually Mike it has happened.

In the MC magazines I read there have been recent reviews of electric bikes.

Unfortunately, they are not of interest to me so I don’t recall names or how readily available they are. I do recall they were a bit pricy, but reviewed favorably.

That’s pretty smart move on your part Mike! Not bad at all to make 40% quickly without paying any taxes. It can’t get any better than that.

[…] Tesla Cars: Why Investing in it May Make You Rich The investor of today does not profit from yesterday's growth. — Warren Buffett If you are wondering, the title indeed is dubious. And that's by design. I am not suggesting that buying a Tesla car may make you rich. At the hefty price tag, it can certainly… Read more […]