In the short run, the market is a voting machine but in the long run it is a weighing machine. — Benjamin Graham

The stock market is flirting with new highs in last five years and euphoria is omnipresent: pundits on TV tell us that it’s insane to miss the boat. While battle between bulls and bears is raging, I thought of seeking wisdom from the master investor — one and only Warren Buffett.

Most analysts hate him because he won’t give them guidance. And media ignores him because he won’t predict stock prices. Nonetheless, Oracle of Omaha has uncanny ability to learn from history and to consistently beat major indices while most Ivy League educated fund managers fail to beat the market.

In pursuit of seeking true wisdom from the greatest investor, I found a pearl of wisdom from his speech at Allen & Company back in 1999 when market was irrationally exuberant.

Interest Rates

In economics, interest rates act as gravity behaves in physical world — Warren Buffett

Any changes in the interest rates impact all financial assets. His hypothesis is simple: we tend to forget what an investment is. It’s a process of laying current dollar with expectation of receiving higher future value of the same dollar. Having said that, a dollar invested when interest rates are at 10% will yield lower return than the same dollar invested when interest rates are at 5%.

While interest rates are low since Fed Chairman has pledged to keep rates lower till our economy runs on all engines, I can only think of rates going higher in the future. Even if rates remain low, it won’t go lower than the current rate.

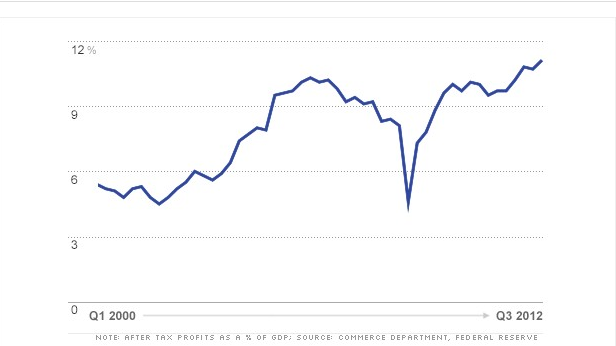

Corporate Profits

Another vital factor is the corporate profitability. For most of the last century, corporate profits was in 4-6% range. Corporate profits accounted for more than 11% of GDP in the last four quarters. That’s a staggering number even for Warren Buffett who predicted that it’s difficult for corporate profitability to remain higher than 6% consistently.

While higher corporate profitability dictates higher returns, any financial turmoil can ruin the party.

Relationship between the total value of U.S. stocks to GNP

Relationship between the total value of U.S. stocks to GNP

This is the single most important factor to gauge future market direction. Historically, total stock market value has ranged from 35% to almost 190% of GNP. Oracle of Omaha considers 75% and below as an indicator that market is largely undervalued to over 100% as largely overvalued. While market has not soared to 190% of GNP as it did back in March of 2000 before the collapse, it has briskly moved up to 110% of GNP.

While both interest rates and corporate profitability indicate that all is well, Oracle of Omaha has the ultimate advice for us mere mortals: People are habitually guided by rear view mirror, and for most part, vistas immediately behind them.

While both interest rates and corporate profitability indicate that all is well, Oracle of Omaha has the ultimate advice for us mere mortals: People are habitually guided by rear view mirror, and for most part, vistas immediately behind them.

This wisdom speaks volume about the marvelous mix of simplicity and financial genius of the master investor.

We often — most of us — sell when market is too low and buy when market is too high as we are, indeed, guided by the rear view mirror.

History largely backs his hypothesis. In early 1900s, in the midst of the greatest industrial revolution, while GDP was growing rapidly, market barely moved higher. On the other hand, in the last few decades of the century, GNP grew at the half of what it did in the previous 20 years, yet markets zoomed to a new high.

Markets can march higher as long as interest rates remain low and corporate profits remain high, but both of those have hit the plateau. If you like simplicity of Warren Buffett, start thinking twice before adding more dollars to your investments as stock prices go way ahead of US GDP.

This is one reason I don’t have cable. It allows me to seek true wisdom while most people mortgage their minds to CNBC. Do you agree?

I’ve seen more people fail because of liquor and leverage – leverage being borrowed money. You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing. — Warren Buffett

Readers: Before you plunge your hard-earned money into the stock market, I highly recommend you to read series of articles written by one of my favorite bloggers, Jim Collins. You must read this article on Mr. Money Mustache before investing in the stock market.

Hi Shilpan…

Thought provoking as always!

With my house just sold, next week I’ll have a chunk of cash to deploy. I’ll be putting to work immediately and when the dust settles my allocation will still be:

50% VTSAX (stocks)

25% VGSLX (REITS) my home equity was included in this percentage already

25% VFIDX (bonds)

Thanks so much for the kind mention and the link to my blog.

For those who might be interested on my stock series of posts, might I humbly suggest they start here:

http://jlcollinsnh.com/2012/04/15/stocks-part-1-theres-a-major-market-crash-coming-and-dr-lo-cant-save-you/

Cheers!

JC

Jim,

No need for thanks as you’ve done the hard work of putting treasure on your blog that all of us can cherish and learn from.

We will never let you stop writing..

I agree completely that avoiding CNBC is key to investing success. It’s about entertainment, not money.

Ditto, Kurt!

Great way to plot GNP and the stock market! There’s another chart I like to look at and keep updated, and that’s the PE of the market. Like your first chart, it starts with corporate profits and then relates it to the stock market as a whole. If you look at it (http://bit.ly/SP500PE) it doesn’t look like the market is close to the peaks that preceded the previous two crashes… yet.

I don’t have cable too and I agree with you and Buffet!

Rose

I agree with your general assessment, but what about the next logical step. If the market is too high and interest rates are very low, where do you put investment money today…

Scott