The new political gospel: public office is private graft. — Mark Twain

Fiscal cliff is an omnipresent term discussed often in the media lately. It reminds me of a famous phrase: stuck between the rock and a hard place. Indeed, our government has a tough act to balance.

What is the fiscal cliff? It is nothing but culmination of the poor budgeting and reckless spending by our government officials. If you spend more than your income, a day of reckoning will force you to make more money and spend less. That’s exactly what will happen on January 1st, 2013.

When you deal with your own fiscal cliff, you have to find another job to increase your income or to scale down your lifestyle to cut spending; when our government deals with a fiscal cliff, it can take more money out of your pocket without your consent. It would be nice if you can demand more salary from your employer to pay for your poor money management skills. So, I have lots of respect for politicians for having skill to manage their own personal finances with a different mindset than how they deal with our nation’s finances.

How Fiscal Cliff Impacts Your Wallet

In a layman term, fiscal cliff will trigger $1 trillion in spending cut over the next 9 years. It will also cause Bush tax cuts to expire. If you think that only rich will feel the impact of expiring Bush tax cuts then you are up for the rude awakening.

Your income tax will go up no matter how much you make. If you are in 10%, 15%, 25%, 28%, 33% or 35% tax bracket, you will move up to 15%, 28%, 31%, 36% and 39.6% respectively. That translates into tax hike of $1154.5 for a family making less than $35,350 a year. Think about the impact the tax hike will have on our economy which is growing at an anemic rate.

The Social Security tax rate will revert back to 6.2% from the current 4.2%. That’s the share you pay in addition to what your employer pays to IRS. Anyone making $50,000 a year will see $1,000 raise in their Social Security taxes starting January 1st, 2013. Considering that Social Security tax is assessed only on the first $110,100 in realized income, someone making $50,000 will feel a sucker punch more so than someone making $500,000.

Alternative Minimum Tax for the year 2012 will fall to $33,750 for individuals and $45,000 for married couples; that’s down from $50,600 and $78,750, respectively.

Medicare payment rate for doctors will be reduced by additional 27%. Many of my doctor friends have indicated that they will have to resort to forcing patients to visit more than required to survive these drastic cuts. If that’s the case then those of you on Medicare might be visiting your physician more often than ever before.

I am ceaselessly amazed at how the media and politicians talk about raising revenue(AKA taxes) to make us pay for squandering our hard-earned money for decades.

I understand why everyone is passionate to raise taxes on those who earn more than $250,000, but raising taxes on those who run small businesses will put brakes on our economic growth; worst yet, it may drag us into another recession.

The Perfect Solution

We can bring our paralyzed economy back into a roaring state simply by enacting fair tax and by allowing oil and natural gas exploration across this great nation. Okay, it may not be a perfect solution but definitely close to it.

Fair tax will take away ability from these skilled politicians to pick and choose winners and losers based on what they think is the best for our nation. Do you know how to handle your money well or your congressman?

Most of the soap opera that you are watching on television when two parties act as if each has nation’s interest at its heart, it makes you wonder.

We don’t need elites to run Washington. It’s apparent — from the poor state of our national finances — that we need street smart politicians who can think of common sense solutions to lead our nation out of this fiscal cliff.

Readers: Have you thought about how this fiscal cliff will impact your wallet? If so, please share your thoughts.

Elsewhere:

What Is the Fiscal Cliff? @ Barbara Friedberg Personal Finance

Solution to the Fiscal Cliff: Time to Start Investing? @ Financial Samurai

Personal Loans Aren’t Always Bad Debt @ Modest Money

Buy Nothing Day @ My Money Counselor

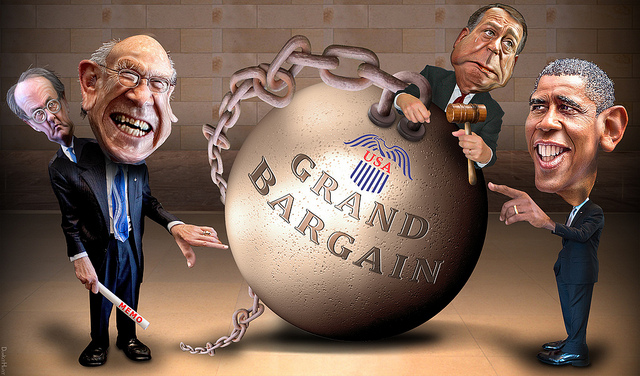

Photo by: DonkeyHotkey

I guess the real cliff might be the big spending, pork, and labyrinth of regulations and perks? Wonder how its all gonna go down.

Amen! I can’t agree with you more, Kevin!

My guess is our esteemed elected officials will find a creative way to once again kick the can down the road.

Thanks for mentioning my piece on Buy Nothing Day!

You can definitely count on them for a creative solution.

In a perverse way, I want us to go off the cliff. Only then will the people vote to get rid of politicians. It takes PAIN to change. We need more pain.

Meanwhile, let me spread out my money and buy some gold.

You are a wise man! There is no real reform without going through real pain.

Regardless of if things expire my budget will be able to handle it. I’ll just save or spend a little less. Either way no sense in worrying until we know what will end up happening.

Indeed, but you have to know what will happen to your wallet if we go off the cliff.

I’m hoping fiscal cliff fears cause the market to dive so I can buy my favorite stocks at deep discounts.

Not a bad idea!

Readers,

I apologize for a mistake I’ve made in calculating taxes. One of my readers, Tim, emailed me with correct calculation:

How are you calculating a tax hike of $4,950 on $35,350? That appears to be a 14% increase, but I don’t see how you got that number. I calculated an increase of $447.5 (~1.3%), using this calculation: Before: $8,950 * 10% + ($35,350 – $8,950) * 15% = $4,855 After: $35,350 * 15% = $5,302.5 Difference: $5,302.5 – $4,855 = $447.5.

My response:

Many thanks for the correction. I am extremely sorry for the mistake. I think, overall, it is going to be more than $447.5 as we need to add 2% for the Social Security tax. so, overall, the increase for a family earning $35,350 would be $447.5 + 2%(35350) = 1154.5

Many thanks to Tim for the correction.

[…] Friday 2012 Roundup“. Shilpan also mentioned this Money Counselor article in his post “How the Fiscal Cliff Impacts Your Finances” at Street Smart […]

I wonder if we go off the cliff if that will inspire more than 50% of the population to vote in the next election? Maybe that would accomplish something. I actually know our US Congressman. He is my neighbor. I am not on a have over for dinner friendly basis, but I’ve know him and his family for years. He is a very successful businessman who should have great ideas for how the country should be run. However, the politcs and gridlock in Washington just kills any sort of idealism and they all just turn into party puppets. It’s really sad. I don’t think they will let all the tax cuts expire, but I’m curious to see what will happen.

Kim, it would be a good article idea to discuss his thoughts with your readers!

Very well explained Shilpan! They’ll play this till the very end and then come to an agreement. The markets will cheer. Same thing happened last time as well.

I’m happy the GOP is standing up for the minority! (1%)

I agree that an agreement will be reached right before the end of the month. It shows that our elected officials are working hard for us. 🙂

I really thought it would take longer for Obama and the other politicians to embarrass us after the election, but here we are – right out of the gate. I’m not feeling very concerned about the economy going into a minor recession – this will just give me the opportunity to buy more assets on the cheap.

I like your perspective, MMD!

I haven’t thought about it too much. I watch my spending closely already so I think I’ll be okay. The media sure is hyping things up though. I feel like anytime I turn on the TV someone’s talking about fiscal cliff.

I can’t agree with you more about the main stream media!

[…] How the Fiscal Cliff Impacts Your Finances The new political gospel: public office is private graft. — Mark Twain Fiscal cliff is an omnipresent term discussed often in the media lately. It reminds me of a famous phrase: stuck between the rock and a hard place. Indeed, our government has a tough… Read more […]

[…] How the Fiscal Cliff Impacts Your Finances on Street Smart Finance […]

Dangerous stuff, Shilpan. Now you’re talking like one of those crazy libertarians…

I like your thoughts! 🙂