Rule No. 1: Never lose money.

Rule No. 2: Never forget rule No. 1. — Warren Buffett

Even if you are a novice in the world of managing your own wealth, you need to think strategically about how you are going to manage wealth.

The phrase ‘wealth management’ sounds like something that is more complicated than it actually is.

These 5 essential tips will help you build your financial well-being like a pro.

Tip 1: Have liquid savings

Illiquidity is a word in personal finance that does not inspire a lot of warmth. Property and jewelry are two examples of illiquid investments that the rich and famous are known for having.

It’s also important to have cash savings that are squirreled away in a safe place especially if you need them for an emergency.

Try to save minimum 20% every month.There is an instant feeling of self-confidence to have cash in your pocket, in the same way that a borrower who likes fast cash loans online, you will definitely prefer having more cash available compared to only having a portfolio of illiquid investments.

Tip 2: Use credit only when you can pay on time

Part of wealth management is knowing how to use credit wisely so that you can use it to your advantage. Credit includes all types of loans such as unsecured loans, mortgages, and a loan for bad credit.

Paying back your credit on time is absolutely crucial for your success which is why you should only use credit if you know that you can pay it back in full every month. A credit history of applying for credit and paying it back on time will helpyou build a solid financial track record that lenders in the future will look at.

Remember, it’s not bad to use credit card; it’s bad to use it for impulse spending that you can’t afford to pay without paying any interest on it.

Tip 3: Have an achievable goal in mind

Wealth management also involves knowing what your goals are. If your dream is to own a home or if you want to buy a car, you need to think and plan your investments to generate cash needed for the big-ticket items.

It’s nice to have a dream to buy a home or even a nice luxury car; however, it’s foolish to dream without planning how to build wealth to buy a home or a car. Every dollar spent by mortgaging your future and happiness can lead your life to financial misery.

Tip 4: Start planning for retirement

Retirement should be on your mind even if you are just dipping your fingers into wealth management. Most people who are passionate about retirement are trying to think about the various ways that they can afford to retire.

For example, this could include paying off the mortgage before officially retiring. Planning for retirement should be a mix of how you want your lifestyle to be when you retire; whatever your dreams are, incorporate them into your wealth management moves now so you can reap the benefits later.

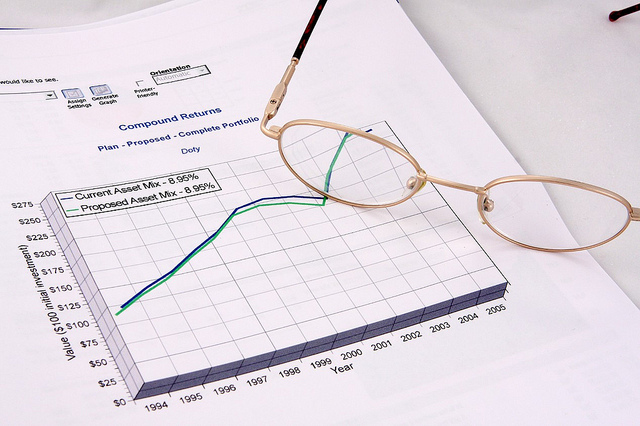

Tip 5: Create a long-term strategy

Wealth management should also be about wealth creation and preservation. The long-haul view is better than short-term ‘get rich quick’ schemes which have plagued some beginners in wealth management.

As an investor, you should be focused on making a long-term strategy that could reap rewards for you in the future. Long term strategy can include interest-bearing savings accounts, investments in property and investing in the stock market, depending on where your interests lie.

Readers: Have you develop a plan for your financial well-being? I’d like to hear your thoughts.

Elsewhere:

CD’s are for hypocrites @ Funancials

Taxes Suck and Make Me Want to Shut down my small Business @ Untemplater

Stocks Part XII Bonds and a bit more on REITS @ Jlcollinsnh

Photo by: Michle.Johnson

Thanks for the mention Shilpan! Another reason why I hate taxes is there are so many deadlines to remember. I missed one by about a week because I thought it was due on the 30th but it was actually the 15th. Doh.

Agreed, Sydney! I can’t believe that we are getting penalized to pay our hard-earned money to our big government. Incredible!

Good tips Shilpan! I always find it odd when people ask what am I going to ‘spend’ my tax refund on. Nobody asks, how I’m going to ‘invest’ it.

And thanks much for the mention!

We have been trapped in the never ending cycle of ‘earn to spend’ ; there is no cure for that disease.

[…] 5 Essential Tips for Your Wealth Management on Street Smart Finance […]

These are some great foundational steps, Shilpan! While some people think this is really basic, they still fail to follow through and implement these steps. If people just did it they’d be WAYYYYYY better off than most!

Agreed. As a financial adviser, I am sure that you are meeting lots of people who struggle to get financial peace.

Another excellent post. Most people only think about how they are going to use their current paycheck. Good steps to help you look beyond today and prepare for the future. Otherwise, you never start to prepare.

[…] post: 5 Essential Tips for Your Wealth Management | Street Smart Finance ← 1000 Tips Earn Money: How to Become Wealthy – the Insider […]

[…] 5 Essential Tips for Your Wealth Management at Street Smart Finance. Shilpan reminds us to look at the big picture rather than what we are going to buy today. […]

I love tip #2. Many people stay away from debt products, not realizing that if used correctly, these can be weapons that help you achieve wealth more quickly.

Thanks for the shout out. I wish there were billboards plastering #2. Too many people use credit carelessly and then blame “the credit” itself. It’s funny (but not really).

So true, my friend!

Among the all tips I am in more favor of the 4rd tip i.e. start planning for retirement. These tips are going to helpful to everyone.

[…] 5 Essential Tips for Your Wealth Management – Managing your money doesn’t have to be hard. These tips will have you feeling like a pro in no time. […]

All the tips are useful and essential for wealth management. I like 2nd one. If you can’t pay credit then don’t use credit. Thanks Shilpan for such a useful post.

I strongly agree with you that people should have liquid savings. Too often people are caught up in investing their money, that they completely do away with their liquid savings. Then when trouble strikes and there is an emergency, they have to deal with illiquidity. This means a lot of hefty fees for early withdrawal from investments, and losing a lot of money. I’m glad you put this first, and that you suggest that we save 20% every month. This is a huge step when it comes to wealth management.