Have you ever heard someone say, “You are known by the company you keep”? The cliché’ was intended to foster good habits by having good friends. Yet, you can use that wisdom — to buy stocks — to profit from this economy with record corporate profits.

Do you know that corporate profits accounted for 14% of the national income in 2010 while real wages are going down? And to spice it up — this is the highest proportion ever recorded.

A street smart’s approach would be to capitalize on the trend by — investing in companies that are best of the breed.

A street smart’s approach would be to capitalize on the trend by — investing in companies that are best of the breed.

If I were to pick handful of companies, I would apply my common sense personal finance approach to pick only the best rock star companies. Historically, stock price has a direct relationship with consistent earnings per share growth and sales growth of the given company.

As an astute student, I have been relentless in learning which stocks to buy to grow my nest egg based on proven, consistent stock selection rules.

With that in mind, I have several rules to consider for you before you consider any stocks to buy.

1. Earnings per Share(EPS)

Like a star athlete, an awesome company ought to make awesome after-tax earnings per share. It is also important to focus on the consistent growth to weed out any one time aberration.

The secret of stock price move lies in its ability to grow earnings consistently by offering new products or services that are in high demand. Again, with so many choices, I would consider a stock to buy only if it has grown earnings per share in excess of 25% for the last three years.

2. No debt

We all know that cash is king, right? Debt is evil not only for us, mere mortals, but also for those giant corporations. Debt restricts growth opportunities for many young companies due to the uncertain economic times that we live in. Any company with cash has plethora of options to grow its market share by introducing innovative products without jeopardizing its financial fate. These cash-rich companies can also use their billions or dollars to — boost dividends, buyback shares or acquire other growth companies to increase their market share.

3. Power to dominate its niche

Legendary General Electric CEO used to sell any division that failed to dominate its niche by claiming first or second place in its niche. A company’s ability to ride out any storm relies on its power to dominate its niche. This is the most important factor that I consider while considering any stocks to buy. It’s inevitable for a growth company to dominate its niche to grow earnings per share consistently and to grow its cash hoard.

4. Profit margin

Consistent top line revenue growth is essential but profit margin is a magic word when it comes to consider any stocks to buy. Why? Profit margin indicates company’s ability to offer awesome products or services that are in high demand. Apple sits on a mountain of cash because of its ability to sell iPhone and iPad with the profit margin of 40%. And when profit margin rises, it lifts the company to a new high. I look for healthy profit margin, in excess of 20%, from a rock star stock.

Return on equity indicates how effectively a company deploys its capital to return profit for its shareholders. I normally prefer a rock star company to return 20% or more on its equity.

So — without further ado — let me introduce you to five rock star stocks to buy and profit from it.

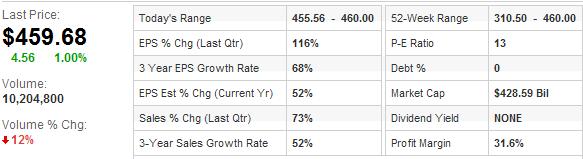

1. Apple(AAPL)

Who doesn’t know Apple? Riding on the mobile euphoria, Apple can’t keep up with demand for its new iPhone and — soon to be launched — ipad3 on Steve Jobs’s birthday.

Who doesn’t know Apple? Riding on the mobile euphoria, Apple can’t keep up with demand for its new iPhone and — soon to be launched — ipad3 on Steve Jobs’s birthday.

For a company of its size, Apple’s growth has been nothing short of stunning. Both sales and earnings per share are growing at annualized 52% and 68% respectively.

- Earning per Share: Apple is growing earnings per share(EPS) by average 68% for the last three years.

- Debt: Apple has no debt. Apple has increased its cash hoard by $97 billion in last five years.

- Power to dominate: Apple dominates smart phone business with its iPhone and iPad2. It also is about to take over personal computer market lead from HP with its strong Mac sales.

- Profit margin: Apple’s profit margin of 31.6% is above average for the niche that it dominates. It’s return on equity is whopping 41.2%

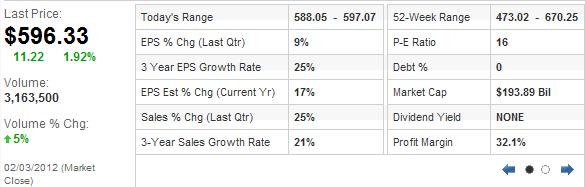

Google — despite missing earnings this quarter — is still the search mogul. Internet has become an integral part of our lives. And major corporations are increasingly spending more on internet marketing to earn their share of this fast growing marketplace. Google has been the major beneficiary — with its AdWords program — of total ad revenue generated on the Internet.

- Earning per Share: Google is growing earnings per share(EPS) by average 25% for the last three years.

- Debt: Google has no debt. Google has increased its cash hoard by $44.63 billion in last five years.

- Power to dominate: Google leads the search engine market with its astonishing 84% market share.

- Profit margin: Google’s impressive 32.1% profit margin proves its dominance in the search engine business. Its 22.6 % return on equity is equally impressive.

3. Bidu

Bidu is the dominant search engine in China. Bidu has been directly benefited from Google’s departure in China. Baidu CEO Robin Li plans to enter “dozens of markets” outside China and Japan over the next 5 to 10 years. With growing usage of Internet in Asian continent, Bidu is poised to gain market share in Asia.

- Earning per Share: Bidu is growing earnings per share(EPS) by average 88% for the last three years.

- Debt: Bidu has 1% debt. Bidu has increased its cash hoard by $1.86 billion in last five years.

- Power to dominate: Bidu has muscle in Chinese search engine market with 80% market share.

- Profit margin: Bidu has 51.6% profit margin and over 50% return on equity.

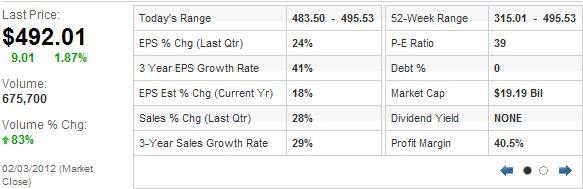

4. Intuitive Surgical (ISRG)

Intuitive Surgical is market leader in the surgical robotics which was little more than a curiosity until 1999 — the year Intuitive Surgical introduced the da Vinci® Surgical System. Today, Intuitive Surgical is the global leader in the rapidly emerging field of robotic-assisted minimally invasive surgery. ISRG has installed da Vinci® Surgical system in 1,450 academic and community hospital sites, while sustaining growth in excess of 25% annually.

Intuitive Surgical is market leader in the surgical robotics which was little more than a curiosity until 1999 — the year Intuitive Surgical introduced the da Vinci® Surgical System. Today, Intuitive Surgical is the global leader in the rapidly emerging field of robotic-assisted minimally invasive surgery. ISRG has installed da Vinci® Surgical system in 1,450 academic and community hospital sites, while sustaining growth in excess of 25% annually.

Earning per Share: ISRG is growing earnings per share(EPS) by average 41% for the last three years.

Earning per Share: ISRG is growing earnings per share(EPS) by average 41% for the last three years.- Debt: ISRG has no debt. ISRG has increased its cash hoard by $292 million in last five years.

- Power to dominate: Intuitive Surgical has created new market with its da Vinci system.

- Profit margin: ISRG has 40.5% profit margin and over 21% return on equity.

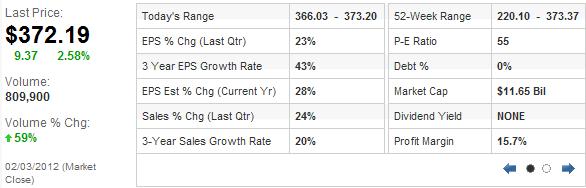

5. Chipotle Mexican Grill(CMG)

Chipotle mexican grill has seen meteoric rise in the fast food segment. It’s innovative idea of serving high quality, delicious food quickly with an experience that not only exceeded, but redefined the fast food experience. As of April 2011, Chipotle Mexican Grill has opened 1163 locations and it plans to open several hundred more every year for the foreseeable future. With ever-growing demand for its high quality, organic fast food concept, Chipotle Mexican Grill has potential to grow in American and beyond.

Chipotle mexican grill has seen meteoric rise in the fast food segment. It’s innovative idea of serving high quality, delicious food quickly with an experience that not only exceeded, but redefined the fast food experience. As of April 2011, Chipotle Mexican Grill has opened 1163 locations and it plans to open several hundred more every year for the foreseeable future. With ever-growing demand for its high quality, organic fast food concept, Chipotle Mexican Grill has potential to grow in American and beyond.

- Earning per Share: CMG is growing earnings per share(EPS) by average 43% for the last three years.

- Debt: CMG has no debt. CMG has increased its cash hoard by $409.88 million in last five years.

- Power to dominate: If you eat at Chipotle Grill, you will become a fan. It has created a new market for high quality, healthy fast food.

- Profit margin: CMG has healthy profit margin of 15.7% and equally imressive return on equity of 23.3%.

Great picks and an interesting rationale. Baidu is one to watch. Living in China, I am seeing this one growing massively.

Mark,

Agreed. I believe that BIDU has huge potential to grow for the next 5 years.

With Google coming back into the China market, I wonder what impact that will have on Baidu’s growth, considering that it was fueled at least in part by Google’s exit.

That’s an interesting thought. Google still has over 70% market share worldwide. So it can change the search engine landscape in China.

While these are all great stocks to own, I think buying them now would be chasing a high.

What seems high can go higher. I think these companies are well positioned to grow their earnings per share at the same impressive rate for next several years.

[…] 5 Rock Star Stocks to Buy for 2012 Have you ever heard someone say, "You are known by the company you keep"? The cliché' was intended to foster good habits by having good friends. Yet, you can use that wisdom — to buy stocks — to profit from this economy with record corporate profits. Do you… Read more […]

Great site and post. Love the layout. Bittersweet for me as I bought and sold 4 out of these 5 stocks years ago. I outsmarted myself. This post could be renamed to buy and hold on!

I agree with you. These are best of the breed, well managed companies. Thanks for stopping by.

[…] 5 Rock Star Stocks to Buy for 2012 Have you ever heard someone say, "You are known by the company you keep"? The cliché' was intended to foster good habits by having good friends. Yet, you can use that wisdom — to buy stocks — to profit from this economy with record corporate profits. Do you… Read more […]

With BIDU, I’d have to get over my bias against Chinese stocks. Good article!

Yes, BIDU is a rare gem in the Chinese stock market. It has all the underpinnings of a great stock.

[…] was trading at $459.68 on February 4th, 2012 when I published my model portfolio. Today — after the closing — it is trading at […]

Hi Shilpan….

how about an update on these? The only one I’ve followed has been AAPL, great call on your part.

Since touching 700 it’s pulled back a bit. are you still loving it at these levels and with the new iPad competition?

Great idea, Jim! In fact, I was pondering over this last week. Great minds think alike. 🙂

I will have an update soon…

[…] of us. It was none other than Jim who recently commented on the original article I wrote about the best stocks to buy in early […]