Social security has been part of the heated debate among the front end Republican contenders seeking the Presidential nomination from their party. Many from baby boomer generation are wondering about the best social security retirement age to maximize their benefits.

I stumbled across a video — by Modus advisors — with interesting facts about the impact of social security retirement age on the overall benefits that a retiree receives over the period of retirement.

Here’s why I think it is best to wait until the Full Retirement Age or FRA to start receiving your benefits.

You will receive less amount for the early social security retirement age.

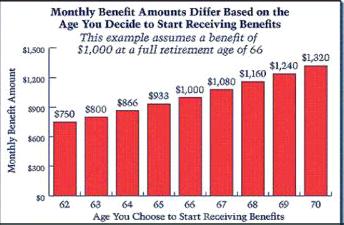

Full Retirement Age or FRA differs for different age groups. So, if you were born between 1943 and 1954, your Full Retirement Age would be 66. If you choose to retire before 66 then you may receive 5-7% less social security benefits compare to full benefit at the age of 66. As depicted in the graph, anyone who retires at age 62 will receive $750 per month compare to $1000 if he or she waits until the full retirement age to receive social security payments.

Tax consequences for early start.

Anyone who makes over $14160 and receives benefits before reaching the full social security retirement age will have benefits reduced by $1 every $2 he or she makes over $14160. So, if some retires at age 62 and makes $20,160 then IRS will withheld $3000 in taxes. Your benefits will be reduced by $1 for every $3 you make over the $14160 limit in the year you reach FRA. You will receive full benefits once you reach FRA regardless of how much you make.

IRS calculates taxes by using combined income formula to assess taxes on any income other than the social security income. Combined Income (C.I.) = half of your social security benefit + AGI( Adjusted Gross Income) + Non-taxable Interest. For a married couple filing jointly, there is no income tax until you make over $32,000. For every dollar over that amount, 50% of you benefits becomes taxable. And once you make more than $44,000 — 85% of you social security benefits becomes taxable.

It’s obvious that the best social security retirement age is not until after you reach FRA or Full Retirement Age. So, if you need more income while you are working before you reach FRA, think about drawing benefits from your 401(k) or Roth IRA and defer retirement until you reach FRA to maximize your social security benefits.

But, there are times when you have to begin receiving early retirement benefits; your health condition may not allow you to work till you reach FRA. Or you may not have other sources of income to supplement income loss while you wait to reach your FRA. It’s always best to seek advice from your CPA. Nonetheless, knowing these key facts about the retirement benefits can play an important role in your retirement planning.

Source:

[…] leisure time, you can work part-time to earn 20-30K extra. Keep in mind that once you reach over social security retirement age, you will get a nice check from Uncle Sam to fund your fun activities like golf or cruise to […]