In early 1990s, I was pursuing Master’s in Manufacturing Engineering. As a teaching assistant I used to work with AGVs(Automated Guided Vehicles) and Stereolithography machine. We used to create parts using resin bed and a UV laser solidifying photopolymer.

That was fascinating invention by Charles Hull who invented the machine in 1984. His idea with the machine was to build prototypes using CAD(Computer Aided Design) software. Major automakers including General Motors instantly saw the benefit of Stereolithography machine for the prototypes since the cost was less than sending blueprints to tool-and-die shops.

The cost of the machine was staggering $100,000 in 1988.

In less than three decade since Charles Hull sold first machine at $100,000, Stereolithography machine has now morphed into a 3D printer and you can buy one for less than $2,000.

The Law of Accelerating Returns

Gordon Moore, co-founder of Intel, predicted that transistors in a dense integrated circuit will double every two years. Moore’s prediction proved accurate for several decades and as a result, we are using more powerful computers than the ones that existed just a decade ago.

As transistors double, electrons require less distance to travel so the circuits would run faster; the end result is an overall increase in computation power.

Your smart phone is millions of times more powerful than all of NASA’s combined computing in 1969. A pocket computer has more power than the computers we used for the moon mission.

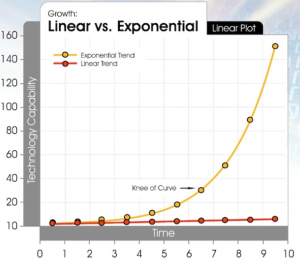

That’s the basis of futurist Ray Kurzweil’s law of accelerating returns. He argues that rate of paradigm shift(technological innovation) is doubling every decade and the power(price-performance, speed, capacity and bandwidth) of information technology is growing exponentially and doubling every year.

That’s the basis of futurist Ray Kurzweil’s law of accelerating returns. He argues that rate of paradigm shift(technological innovation) is doubling every decade and the power(price-performance, speed, capacity and bandwidth) of information technology is growing exponentially and doubling every year.

Ray’s theory of exponential growth is all around us if we start researching price-performance, speed, capacity and bandwidth factors in the last 40 years.

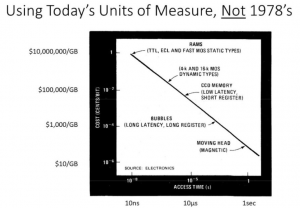

DRAM(Dynamic Random Access Memory) used to cost $100, 000/GB in 1978. It costs $7/GB now in 2018. Interestingly, average house in Silicon Valley was about a gigabyte of DRAM in 1978; it’s $1,000,000 today while DRAM sells for $7/GB.

DRAM(Dynamic Random Access Memory) used to cost $100, 000/GB in 1978. It costs $7/GB now in 2018. Interestingly, average house in Silicon Valley was about a gigabyte of DRAM in 1978; it’s $1,000,000 today while DRAM sells for $7/GB.

This increase in housing price is directly related to what Ray considers economy of scale — as computation power increases and cost decreases, more investments in research and development of both hardware and software fuels exponential growth in the information technology field.

Most of the leading fortune companies in Silicon Valley didn’t exist except Apple which was founded just at the beginning of the revolution in 1976. It is astounding that most of new wealth in the Silicon Valley is being created by handful of companies — Apple, Google, Facebook.

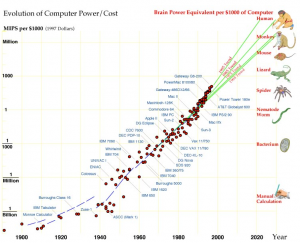

Ray observed in his book, The Singularity is Near: When Humans Transcend Biology, that in 1967 he had access to multi-million dollar IBM machine at MIT with 32K words of memory and quarter of MIPS.

Ray observed in his book, The Singularity is Near: When Humans Transcend Biology, that in 1967 he had access to multi-million dollar IBM machine at MIT with 32K words of memory and quarter of MIPS.

In 2004, he was using $2,000 computer with 500 Megabytes of RAM and the processor speed of 2000 MIPS. So, that MIT machine was about one thousand times more expensive than his 2004 machine.

In 2018, you can buy a HP laptop with 8 GB of RAM and over 304,000 MIPS for $750.

It took ninety years to achieve the first MIPS per thousand dollars; now we add one MIPS per thousand dollars every five hours.

Ray argues that even if Moore’s Law eventually hits plateau, exponential growth in the computational power continues with new breed of innovations that takes over the torch and keeps fueling the exponential growth in computation power.

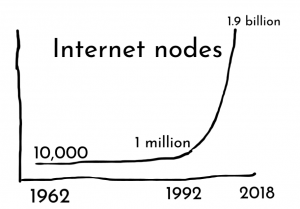

Not convinced? Let’s time travel and review growth of the Internet hosts. Internet dates back to 1962 when ARPA, a U.S. Department of Defense agency connected 10,000 primitive computers. The cost was hundreds of thousands of dollars with few thousands words of magnetic core memory.

Not convinced? Let’s time travel and review growth of the Internet hosts. Internet dates back to 1962 when ARPA, a U.S. Department of Defense agency connected 10,000 primitive computers. The cost was hundreds of thousands of dollars with few thousands words of magnetic core memory.

Fast forward to 1992, Internet had one million computers or nodes with computers that were order of nine magnitude faster with network bandwidth 20 million times better than the one that existed in 1962.

In 2018, the world has over 1.9 billion computers or nodes on the Internet.

We live in a linear world so since rise of the Internet from 1962 to 1992 wasn’t spectacular, we tend to think that the rise continues linearly even if data suggests that the rise has been exponential since 1992. This phenomenon is happening since the beginning of humanity. Those who lived in the age prior to industrial revolution may have not seen any progress even though progress was happening then since it was at a very slower pace. Those who lived during the industrial revolution witnessed faster growth yet it still took long time till the next major paradigm shift in the early 1990s with the advent of the Internet. They also didn’t witness a faster pace in the change even though it did.

Enter the new age — exponential growth in the computational power + Artificial Intelligence = Machines with super intelligence

Artificial Intelligence(AI)

As computational power increases exponentially and cost decreases, machines or robots are built to perform work of higher order. Artificial Intelligence sounds like an esoteric concept but we witness that in our every day lives.

As computational power increases exponentially and cost decreases, machines or robots are built to perform work of higher order. Artificial Intelligence sounds like an esoteric concept but we witness that in our every day lives.

We know that robots fly planes and drive cars but I recently heard that robots are even deployed on the battle field.

Pentagon is poised to spend almost $1 billion for a range of robots designed to complement combat troops. Beyond scouting and explosives disposal, these new machines will sniff out hazardous chemicals or other agents, perform complex reconnaissance and even carry a soldier’s gear. — Fortune magazine

Imagine robot as a container that is being powered by AI. You can consider AI as a brain of the robot. We cease to exist without our brain and so does the robot without the AI.

Vernor Vinge coined the term “Singularity” in 1993. He believes that in the future, something will surpass most repetitively effective feature that human has(intelligence). Ray Kurzweil theorized it as the new age in which the Law of Accelerating Reruns has reached such an extreme pace that technological innovation will happen at seemingly infinite pace. This is when machine will surpass human intelligence to not only perform actions that require extreme reasoning but also at a much higher pace than human mind can.

He predicts that we will witness singularity in the year 2029. He made this prediction in his book published back in 2006 and we are half way through to year 2029 since then.

If you are a fiction writer, writing books on the world post Singularity itself is a fascinating idea. If not, think of how to profit from this major phenomenon as it unfolds in our lifetime.

NVIDIA

Of course, if you are not a stock investor, you can stop reading. As a full disclosure, I have invested in NVIDIA stock since 2017 and I believe that this is one of the leading companies to fuel exponential growth towards Singularity.

It’s a leader in GPU(Graphical processing Unit) and AI. The stock has doubled since I invested at $139 in 2017. But, I think this is just the beginning.

NVIDIA just announced new Turing based GeForce RTX gaming GPU series with ray tracing. Ray tracing in real time will enable developers to achieve cinematic quality in their video games.

What was expected to be developed in 1928 has been developed by NVIDIA in 2018 so this is a remarkable feat as the pace of the technological innovations accelerate with new breed of higher power technologies with increasing level of intelligence.

NVIDIA and other cutting edge companies lead the charge towards the paradigm shift whether Ray Kurzweil’s prediction of Singularity may happen in year 1929 or later. It’s not if but rather when it will happen.

A life in the new age awaits.